What are AI-Tools – and what benefits do they offer you?

From our experience with data analysis projects, we know: What managers really need are not complicated reports, but clear and immediately actionable recommendations.

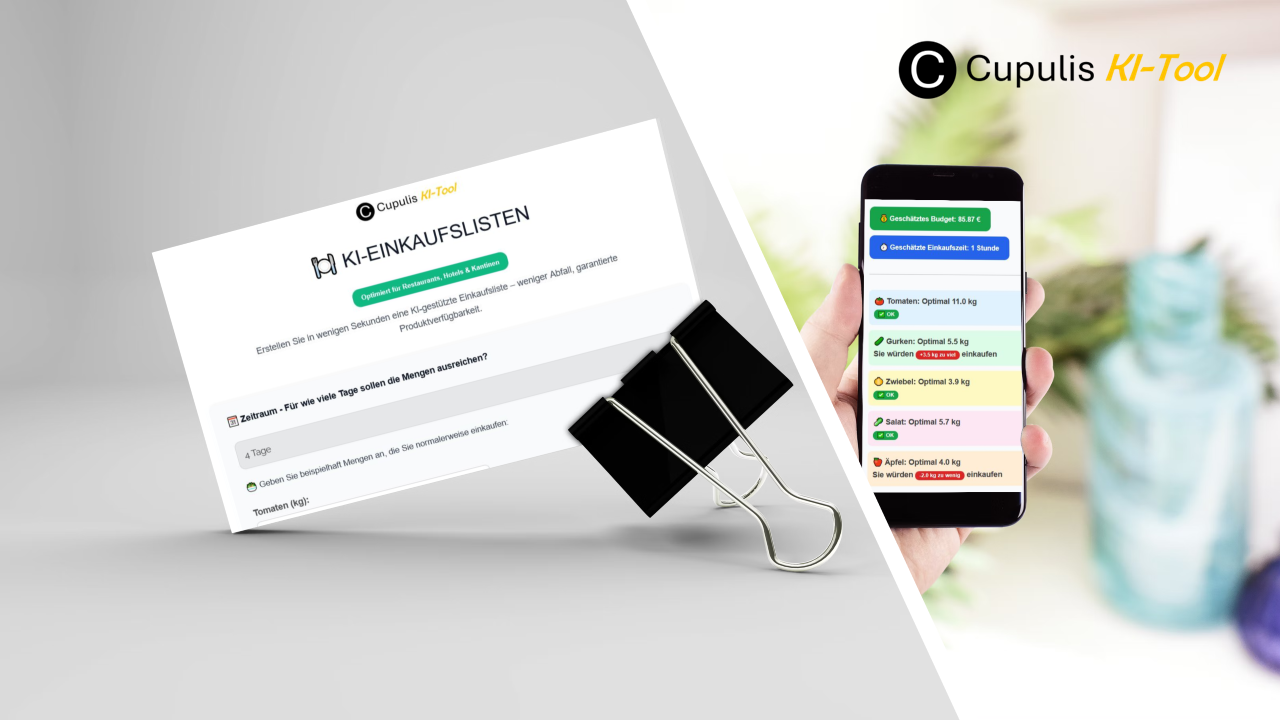

This is exactly why we develop individual AI-Tools. They act like a strategic assistant, automatically translating your analysis results into concrete steps. Imagine a decision-maker who can access insights from millions of data points at any time and apply them to your goals in real-time – with a speed and precision that far exceeds human capabilities. That is the power of our AI.